The main reason to invest to make money. Of course you have to consider the risk of investing and balance that with the potential reward. But how do you actually make money from investing in the stock market?

This article explains the two ways you can make money from investments.

Make money from increases in share prices

The first way to make money by investing is through increases in value. Assuming your stock market investments increase in price over time, this increases your net worth.

Ultimately the investments could then be sold for profit.

The simplest example is real estate. If you bought a house for £200,000 and it increased in value to £250,000, you could sell it for a profit.

The same is true for stocks and shares.

For example, if you invested £1000 in an index fund when you were 28. A conservative estimate is 4% growth per year on average (some years may be less, others may be more).

Your £1000 may possibly approximately grow like this:

| Year 5 | £1216 |

| Year 10 | £1480 |

| Year 15 | £1800 |

| Year 20 | £2191 |

| Year 25 | £2665 |

| Year 30 | £3243 |

| Year 35 | £3946 |

| Year 40 | £4801 |

By 68 your original £1000 could be worth around £4800. (Or it could be worth more or worth less. With the stock market no-one knows.)

This is without adding to that original £1000. It’s just gaining value as the stock market fluctuates but slowly travels upwards over time.

At 68 you could then sell your £4800 of investments and use the money to go on a cruise.

Multiply that initial £1000 by 10 and those numbers quickly jump.

Have £10,000 invested by the time you’re 38 and that could grow in value to over £30,000 by 68.

Boost your investment gains by buying low and selling high

The basic principle of stock market investing is buy low and sell high.

This applies whether you invest in funds, in real estate or stocks in individual companies.

But actively following the market and trying to calculate when to buy and sell is a tricky business. Professional analysts don’t always outperform the typical index fund.

The logistics of selling – drawing down on your investments in retirement and rebalancing your portfolio due to stock market changes – are topics for another day.

Recap: If your investments increase in value, you can make money by selling them for profit.

But you may not want to sell these assets.

What if you don’t want to sell?

You’ll probably want to live in your house or sell it to buy a new one. (That’s why your house isn’t truly an asset.)

If you’re investing for your future, you’ll generally want to keep a chunk of money invested whether that’s for early retirement, a sabbatical year or a house deposit.

So other than selling your investments, how can you make money from investing in the stock market?

Make money from quarterly payouts: investment dividends

The second way that stock market investments make you money is by paying you dividends.

How dividends work

For each share you own you are periodically paid a dividend. These are usually paid quarterly. This amount varies per fund and per quarter but you could typically expect it to be in the region of 1-5%.

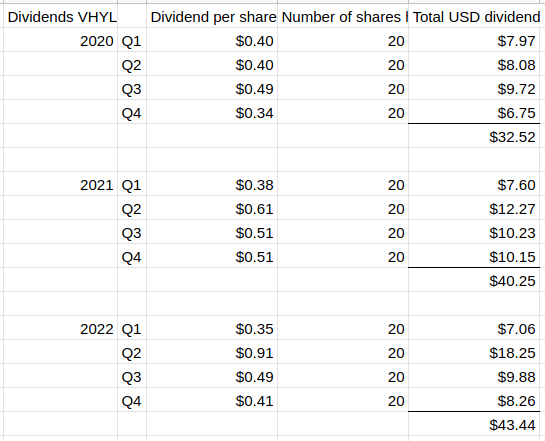

For example, let’s say you had 20 shares in VHYL – a high-yield global ETF. (At the time of writing, this would be approximately £960 invested).

As you can see from the table above, the dividend per share is set each quarter depending on factors like the performance of the companies in that fund.

The historical expected yield for VHYL is around 3% (that’d be something like £300/year for each £10,000 invested). In reality, it varies from quarter to quarter as shown in the table.

Do all funds pay dividends?

Some funds don’t pay out dividends but are instead set up to automatically reinvest your dividends.

For example:

VWRL is a distributing fund which pays dividends while VWRA and VWRP are accumulating funds that automatically reinvest.

Which to choose? Theoretically there is no difference in terms of return on your investment. In practice, it depends on what you do with your dividends. If you withdraw and spend your dividends, you’ll have less in your investment account than you would if you kept the dividends in there and bought more funds with your dividend payout.

How do I decide what to do with my dividends?

If you want to start living off your investments, dividends are handy because you earn money every quarter without having to sell your investments.

So you may wish to invest in distributing funds.

Whereas if you’re still a long way of potential retirement or have other long-term goals for your investments, there’s a bit more to consider.

There can be advantages and disadvantages to each share class, particularly if you’re in Europe or your shares aren’t in an ISA.

Accumulating funds automatically reinvest making them easy, hands-off investments. This is particularly good if:

- your provider has a dealing fee

- you don’t invest regularly

- you don’t want to manually check your account to reinvest the funds

However, some platforms offer a reinvesting service where they’ll reinvest the dividends from your distributing funds for you. So the above would be less relevant.

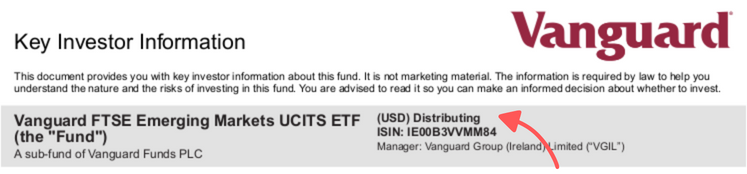

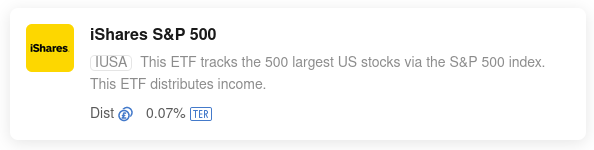

How do you know if a fund is accumulating or distributing?

After doing your research you may have a preference for one or the other. Or you may be keen to get investing now without getting bogged down in too many details.

In any case, it’s good to know how to check the share class of a fund you’re interested in.

You’ll find this information in the Key Investor Information provided by your investment platform.

Other platforms may tell you the share class when you look up the fund.

How much could the dividend payout be?

What does all this mean for the average investor?

Depending on your investment goal, you could choose a growth portfolio or an income portfolio.

A growth portfolio is for investors looking to build their assets. For you investments are for long-term growth so you’d be looking to reinvest your dividends to get you to your goals faster.

An income portfolio is for investors seeking income from their assets. You’d be looking for funds, ETFs and/or bonds that tend to have a high yield (ie. the dividend payment is typically high). This would generate passive income from your investments.

You may find that you want a mixture of the two or that you have different goals for different investment accounts. For example, one goal for your pension and a different goal for your Stocks & Shares ISA.

—

Liked this article? Sign up to get notifications of new posts sent straight to your inbox.

2 replies on “How do investors make money in the stock market?”

[…] costs less in a down market and we’re in the market for the long haul, we’re bound to make a profit […]

[…] starting to invest in stocks and bonds […]