Have you ever tried setting new year’s resolutions for your finances? Maybe you’ve tried a no-spend month. Or decided you want to save an extra £100 a month.

But by mid-January you’ve already been sales shopping and blown your budget.

I’m not the biggest fan of new year’s resolutions as they’re often focused on not doing something, rather than doing something.

I prefer the latter as it’s more positive.

That’s where financial setting goals comes in.

- What are financial goals?

- What is the purpose of financial goal setting?

- What are the three types of financial goals?

- What financial goals are not

- What is the first step in setting your financial goals?

- What are some examples of financial goals?

What are financial goals?

Setting financial goals makes it easier to achieve your life goals, as many goals involve money.

It’s the first step in planning financially for your future.

Financial goals can include short- or mid-term goals – such as paying off debt or saving for a dream trip – and long-term aims like saving for retirement.

What is the purpose of financial goal setting?

Financial goals give you clear direction.

With no specific goals in mind, you’re likely to spend more. An extra £5 here, £10 there.

Having a clear goal can help you stay on track when it comes to saving and spending day to day and month to month. This can help you reach your dreams faster.

Overall, setting and working towards financial goals can help you get ahead in life. You can save up for your big dreams like a once-in-a-lifetime trip or buying a house.

Setting financial goals can help you focus on where you want to be and plan how to get there.

What are the three types of financial goals?

Financial goal setting is an important process for any individual or couple looking to plan for the future. It involves goals in three distinct timeframes: short term, medium term, and long term.

Short-term goals are those that can typically be achieved in less than a year.

Medium-term goals are those that may take up up to 5 years to achieve, such as saving up for a deposit on a home or paying off your car.

Long-term financial goals, or lifetime financial goals, are those that are designed to provide financial stability and security over the course of your lifetime, such as funding a comfortable retirement or paying off your mortgage.

What financial goals are not

They’re not your to-do list. Like tracking down your pensions.

Nor are they your retirement plan.

Nor your investment strategy.

Financial goals are based on your dreams and aims.

Once you’ve decided what you want, you’ll need to plan specific steps to achieve your goals. But first you need to be clear on what you want.

What is the first step in setting your financial goals?

This process involves thinking deeply of the life you’d like to have. Next, take the time to analyse your current financial situation. After that you’ll be able to set specific, time-bound objectives that will help you reach your desired future.

Here are some tips for figuring out your financial goals:

Visualise your future

Think about what you want your life to look like in the future, and then work backwards from there.

Once you have a good idea of your end goal, it’s much easier to figure out the steps you’ll need to take and you can start to make specific plans to get you there.

Think about the details

For example, if starting or expanding your family is on your mind – where will you live? What kind of house? Do you want or need flexible working so you can spend more time with them? Where will you holiday? Do you want to set them up with a nest egg when they come of age?

If you want to retire early – what will that look like? What will you do with your time? Travel? Spend more time on your hobbies? Move to be closer to family?

These things will impact how much money you’ll need. By thinking through the details you might realise you need more (or less!) money than you first thought.

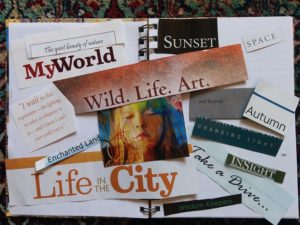

Create a vision board

Once you have some ideas on your dream future, you may find a vision board helps inspire you to work on achieving your dream.

A vision board can be a physical board with images from magazines, words and phrases that represent your ambitions, or it can be digital. You can make it in Powerpoint or use a Canva template. Whatever works best for you.

A visual representation of your dreams can help you stay focused on achieving your financial goals.

Ask yourself why is your goal important

It’s important to ask yourself why each goal is important to you. How will you feel when you pay off your mortgage? How will it feel to go on the trip-of-a-lifetime?

Keeping your “why” in mind can keep your motivation levels high – allowing you to reach your desired goals more quickly.

So it’s actually really important to have a clear reason.

Because saving money can be hard.

Saving for something specific like a house deposit or a round the world trip is much more motivating than just ‘saving’.

It can help to name your savings accounts or, if your banking app allows it, create named savings pots to keep reminding you what you’re saving towards.

Secondly, what you first think of might not be something you truly want or need. For example, you might think you want to upgrade your car, but when you dig deeper that’s because you’re trying to keep up with the Joneses and what you really need is a car that’ll fit a pushchair in it. Which your current car does.

Or your goal might be masking another goal.

For example, you might have a vague idea of buying a house to secure your financial future. But if your true aim is steady income while you retire abroad, that house might not be the best solution.

>> A financial coach can help you figure out your financial goals.

Taking the time to consider why your goals are important will help ensure that you have the necessary focus and commitment to achieve them.

Take your current financial situation into account

Goals are unique to each individual. We all have different dreams and we all have different starting points.

Considering your current financial situation may help you classify your goal as short/medium/long term. This will help you set realistic timeframes for achieving your goals.

Additionally, thinking about your current finances can help you identify potential barriers that could prevent you from reaching the milestones you want to.

Once you’re clear on what you want and where you’re currently at, you’ll be able to make specific, actionable plans to achieve your goals.

What are some examples of financial goals?

Financial goals vary from person to person. Whether a goal is short term or medium term depends on your starting point. Some common money goals include:

Short-term objectives that can be set and achieved in anything from 3 months to a year while mid-term objectives could be up to 3 or 5 years.

Here are some examples of short- or mid- term financial goals:

- saving for a holiday

- saving for Christmas

- paying off credit card debt

- saving for your wedding

- establishing an emergency fund

- saving for renovations

- starting to invest in stocks and bonds

- earning a certain amount of money through a side hustle

- finding a higher paying job

- creating a financial safety net

Beware of confusing to-do list tasks with short-term financial goals. Things like finding a better interest rate for your savings can be sorted in an hour or less. As could consolidating your old pensions if you have the account details to hand.

If you have a few of these smaller tasks, you could set a short-term goal to ‘organise my finances in 3 months’ or ‘sort out my pensions’ including logging in to your current pension provider and finding out what you’re actually invested in, what the fees are etc.

Long-term financial objectives are bigger goals that require more than 5 years, including goals that will help set you up in retirement such as:

- purchasing or upsizing a home

- paying off your mortgage early

- funding a comfortable retirement

- buying a house by 40

- retiring by 60

- providing a nest egg for your children

- feeling financially secure

Some of those could be medium-term for you – it depends on your starting point.

Final thoughts on financial goal setting

Financial goal setting is a powerful tool to help you gain peace of mind, reach financial security and have the money to achieve your dreams. By visualising your future, you can put yourself in a better position to make smart financial decisions and plan the steps you’ll need to take to achieve your goals. This will also help you stay on track and motivated.

Whatever your life goals may be, setting financial goals can help you take control of your finances and progress towards achieving your heart’s desires.

—

Do you have any questions about financial goal setting? We’d love to hear from you.

Struggling to figure out what your financial goals are? Book a free 45-minute coaching call.

—

Liked this article? Sign up to get notifications of new posts sent straight to your inbox.